Treasury Management Software

One unified solution for all your treasury needs

Optimize your liquidity, get powerful insights, and automate workflows. View all your financial accounts on a real-time, global dashboard and generate custom reports with AI.

Automated cash positioning

Instantly see your cash position by entity, region, and currency with real-time cash flow management. Track balances and trends with personalized worksheets and period-based views. No Excel needed.

Real-time cash reporting

See up-to-the-minute cash positions through real-time financial reporting, without waiting for end-of-day reports. Make decisions faster: don’t wait for EOD reports.

Cash flow analysis

Allocate cash optimally and quickly identify pain points. DualEntry constantly screens, analyzes, and shares insights on your cash flow.

Seamless integrations

Get clear, unified treasury insights. Live two-way integrations with your banks, PSPs, billing platforms, and ERP through native accounting integrations.

DualEntry AI

Achieve more in less time. Unlock liquidity insights, get clear answers to complex questions, automate workflows, and more.

Drill downs

Review data at the most granular level with one-click drill downs. Filter transactions by entity, date, account, region, amount...

The DualEntry difference

Automate routine tasks. Access powerful forecasting tools. Get deeper insights without adding to your workload.

Cut out 90% of manual tasks

Leaner teams get more done with DualEntry AI and smart automations. Streamline your treasury workflows and refocus on strategic projects.

.svg)

Onboard easily

Import your treasury data and let DualEntry AI get to work – no technical expertise or coding needed. Set and forget automations that eliminate repetitive tasks.

Feel secure with 24/7 data validation

Have more peace of mind with automated data checks, exception management, and AI that spots anomalies – all helping you manage liquidity risk.

Optimize your financial performance

Create detailed cash projections intuitively, without messy spreadsheets, and get real-time visibility into your future liquidity position.

Your data is always secure

%20(1).jpg)

Enterprise-grade compliance and encryption

We’re committed to robust data security, privacy, and encryption standards. All your information is protected at rest and during transmission.

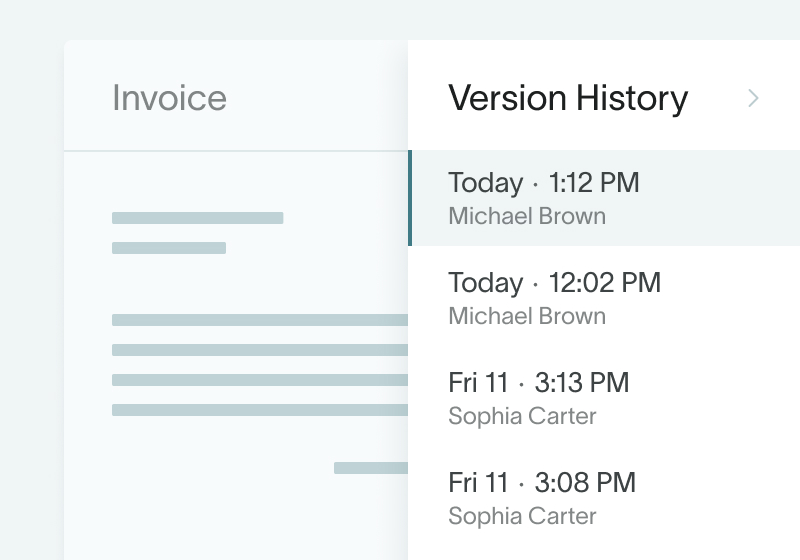

Robust audit trails

Track every change, from configurations and customizations to data updates. Detailed audit trails powered by built-in audit automation show you exactly what’s changed in workflows, scripts, and settings.

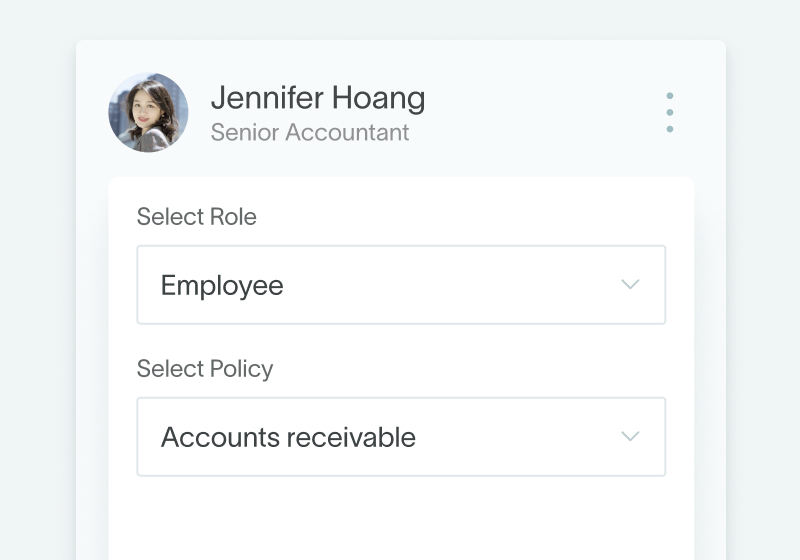

Role-based access controls

Set precise permissions and maintain a strict segregation of duties. You decide who can initiate transactions, approve changes, and access sensitive data.

Faster, richer cash insights with DualEntry AI

Categorization

DualEntry AI automatically categorizes your transactions and suggests new categories tailored to your enterprise’s operational focus.

Reports

Get personalized, shareable reports in seconds, covering any metric and any timeframe, by asking AI.

FX hedging

Optimize your currency risk management with AI that analyzes market patterns and your cash flows to recommend hedging strategies. DualEntry AI monitors exchange rates 24/7 and proactively suggests hedging actions that protect your bottom line.

Copilot

Whether you need a tailored recommendation or simply a quick answer when you’re in a rush, your DualEntry AI copilot is on hand 24/7.

Getting set up is simple

Link your accounts

Securely connect DualEntry to your bank accounts. We make the process fast and easy. The first 50 bank accounts you add are free.

Add your entities

Set up new entities in minutes without IT support. Model your org structure, set rules for inter-entity transactions, and manage it all from one simple, central interface.

Review in real time

Once you’re set up, see all your metrics and reports in real time, in one view – no matter how many entities, locations, or currencies your treasury handles.

Everything you need from

treasury management software

without the extra charges

| Feature |  |  |  |  |

|---|---|---|---|---|

| 24/7 data validation Reduce liquidity risk with continuous, automated data auditing and exception management | Manual verification only | Not supported | 3rd-party or add-on | |

| AI copilot Unlock liquidity insights, get clear answers to complex questions, and automate workflows | Not supported | Not available | 3rd-party or add-on | |

| Two-way ERP integrations | SDK/API only | Integration framework | API integration | |

| AI FX hedging Get personalized, shareable reports in seconds, covering any metric and any timeframe | Not supported | Not available | Not supported | |

| AI reporting Get personalized, shareable reports in seconds, covering any metric and any timeframe | Not supported | Not available | 3rd-party or add-on | |

| Two-way billing-platform integrations | 3rd-party only | Custom integration | API integration | |

| AI categorization DualEntry AI automatically categorizes your transactions and suggests new categories tailored to your enterprise’s operational focus | Not supported | Not available | 3rd-party or add-on | |

| AI anomaly detection DualEntry AI continuously monitors for anomalies and potential risks | Not supported | Not supported | 3rd-party or add-on | |

| IFRS/GAAP compliant | GAAP only | |||

| Two-way PSP integrations | Intuit Payments only | Add-on integration | ||

| 13,000+ global bank connections | Limited bank feeds | SAP MBC required | ||

| SSL compliant | ||||

| SOC Type II certified | Not applicable | Not applicable | ||

| Real-time cash reporting View up-to-the-minute cash positions at any time | Manual updates | Requires integration | ||

| Multi-entity support Review data at the most granular level, filtering transactions by entity, date, account, region, amount, and more | Manual consolidation | Requires add-on | ||

| ISO 27001 certified | Online only | Not certified | ||

| HTTPS/TLS encryption protocols | ||||

| GDPR compliant | Manual steps | |||

| Drill downs Review data at the most granular level, filtering transactions by entity, date, account, region, amount, and more | ||||

| AES 256 at rest and in transit | No at-rest encryption | Configurable | ||

| Cash flow analysis DualEntry constantly screens, analyzes, and shares insights on your cash flow so you can allocate cash optimally and identify pain points swiftly | Basic statements only | |||

| CCPA compliant | Manual steps | Process-based | ||

| Automated cash positioning Automate cash position calculations by entity, region, and currency. Track balances and trends with personalized worksheets and period-based views | No treasury module | Requires integration | ||

| Audit trails DualEntry keeps detailed logs of all system customizations, master-data changes, and modifications to workflows, scripts, and system settings | ||||

| Connect up to 50 bank accounts for free | Up to 40 accounts | 3rd-party connector |

Treasury management software FAQ

What is treasury management software?

Treasury management software helps treasury teams with cash management, liquidity management, banking relationships, and risk management. The main functionality of a treasury management system is that it centralizes visibility, automates cash forecasting, and gives teams more control over working capital.

What does treasury management software do?

A treasury management software helps companies automate payment processing by giving real-time visibility into cash positions, automating bank reconciliations and payments, and helping to forecast liquidity. It also integrates with accounts payable automation software to streamline outgoing payments and improve working capital efficiency.

What are the key features to look for in treasury management software?

The key features to look for in treasury management software are multi-entity support, automated cash positioning, real-time cash reporting, cash flow analysis and forecasting, compliance with IFRS/GAAP, SSL, GDPR and CCPA, and AES 256 at rest and in transit. For organizations operating globally, multi-currency accounting capabilities are essential to manage exchange rates, consolidations, and foreign transactions accurately.

What software do treasurers use?

Treasurers use a lot of software, but the most important is treasury management software. It helps them run strategic financial processes – liquidity, cash flow, risk management, investment planning, and more. The best tools centralize cash, automate reconciliations, and scale with multi-entity complexity.

What is the difference between ERP and Treasury Management System?

The ERP is where you manage your company’s overall finances: things like accounting, AP/AR, and reporting. A Treasury Management System focuses specifically on cash, liquidity, and risk. You can think of ERP as the financial backbone, and treasury software as the control tower, keeping your cash moving safely and efficiently across entities and banks.

Why choose DualEntry's Treasury Management Software?

DualEntry is an AI-native ERP, and its treasury management system gives you a lot of features that legacy tools don't. This includes real-time cash visibility, automated reconciliations, and multi-entity control.

What features are essential in order and invoice management software?

DualEntry’s treasury management software includes everything modern finance teams need to control and optimize their workflows. Here’s an overview of the key features and benefits:

50 bank-account connections for free

13,000+ global bank connections

Multi-entity software support

Real-time cash positioning and reporting

Cash flow analysis and cash forecasting

2-way integrations with ERPs, PSPs, and billing platforms

Built-in cash flow management for complete visibility into inflows, outflows, and liquidity across entities

AI categorization

FX hedging

Anomaly detection

AI copilot for faster insights

24/7 data validation