Put your work on autopilot with accounts payable automation software

Cut out manual entry and invoice approvals. DualEntry’s AI-native AP solution keeps all payments on time and compliant.

Automate time-consuming tasks and have full control and clarity

Never chase another recurring invoice. DualEntry automatically schedules, submits, and follows up on invoices for you, so you can reclaim hours and keep payments on track.

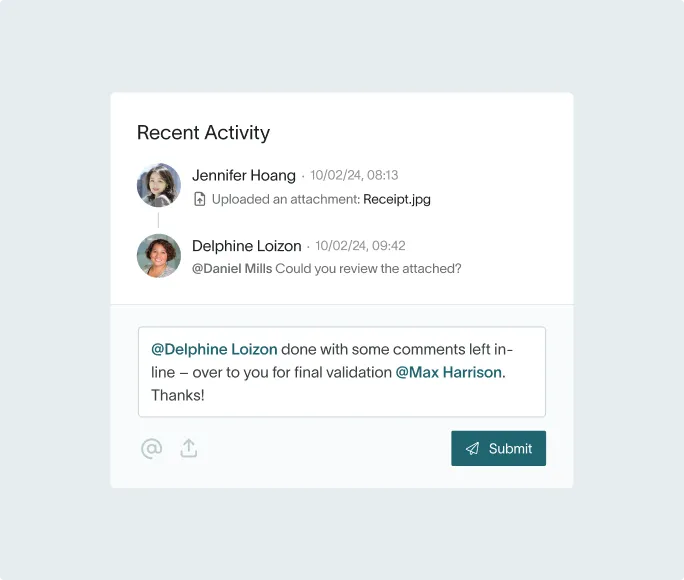

Skip communication gaps and stay audit-ready by keeping all spend conversations in one place. Use @mentions and notifications, and integrate AP approvals into Teams or Slack.

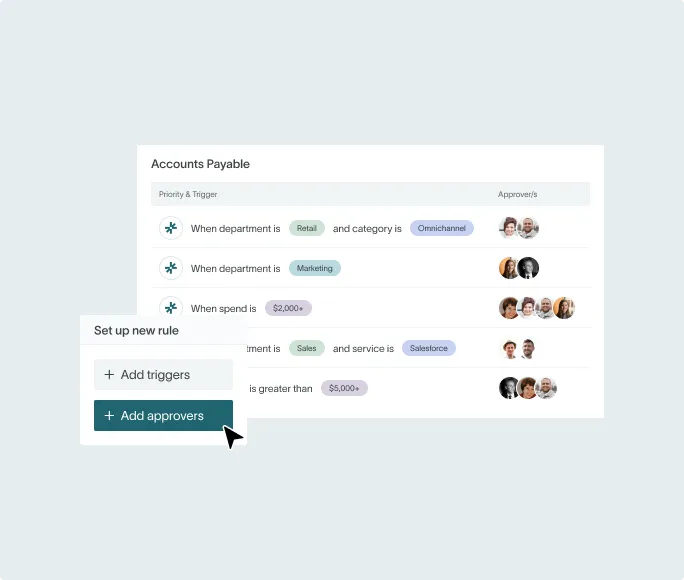

Handle AP your way with custom workflows that match your team’s approval steps. Make adjustments easily as your business grows or reporting structure changes.

Have full control over your cash flow. Schedule payments on your terms and track each one’s progress from start to finish.

Slash the time spent on PO paperwork. Create and approve purchase requests in seconds, and leverage AI-powered automatic routing.

Keep vendors happy by offering faster payments, multiple ways to pay, and early-payment discounts.

Use AI and automations to achieve more in less time

AI payment matching

Handle 2-, 3-, or 4-way matching to prevent overpayments, duplicates, and fraud.

OCR reading

Upload any document, even a handwritten receipt, for DualEntry AI to read and instantly fill the bill details. No manual logging needed.

Anomaly detection

Have full peace of mind as DualEntry AI automatically checks for mismatches between invoices, POs, vendor data, and past transactions. Duplicates are immediately flagged—putting an end to accidental double payments.

Automated journal entries

Close faster as DualEntry creates JEs automatically and posts them to your general ledger. Multi-currency transactions? Split billing? Billing scenarios of any complexity are handled quickly without human intervention.

Automatic reconciliation

Reconcile in minutes with AI’s help. Connect to 13,000+ banks, get instant matches for virtual card charges, and download statements automatically.

Prioritization

Don’t just see your AP data: act on it. DualEntry AI recommends which invoices to prioritize for early-payment discounts, helping you make savings and keep vendors loyal.

Have complete, real-time spend visibility. Drill into the details with a few clicks.

Use your live dashboard to track real-time AP data, from aging reports to payments in transit. Open POs, due dates, prepaid expenses, sales taxes, 1099 payments, and more can be added to your customizable dashboard.

Have full control with bills, receipts and vendor contracts stored in one place. Process bills for multiple entities and accounts with one platform, always.

Connect to 13,000+ banks and see live cash balances in any currency or location with real-time FX rates.

Set up standard or custom AP reports and saved searches by category, department, or location.

Create AP-liability and vendor-aging reports on demand, always working with real-time numbers.

Take the pain out of compliance and audit prep

Document-chasing shouldn’t be part of your day-to-day. DualEntry automatically captures approvals and edits in audit trails, keeping you reporting-ready by default.

Maintain data integrity and accuracy with AP period locking and granular user permissions for approvals and vendor-data changes.

Get a full overview of every vendor with detailed vendor records, including banking info, POs, transaction history, and credit memos. Invoices are automatically checked against vendor data, ensuring accuracy and preventing late payments and fraud.

Feel secure with always-on fraud prevention. DualEntry identifies and requests reviews of first-time payments to new bank accounts associated with existing vendors.

Get out of silos and sync with your spend-management toolkit

Stay on budget with smooth integrations with 3rd-party tools like Ramp, Bill.com, Tipalti, Vic.ai, Coupa, Expensify, SAP Concur, and Airbase.

Connect your default payment providers to pay by check, ACH, or virtual card. Never waste time on manual postage or generating ACH files for banks again.

Keep all your data synced in real time. No manual refreshing; no spreadsheet imports.

Get set up in seconds without calling for IT support.

Why high-performing teams choose DualEntry

for AP automation

For finance teams

Spend less time toggling between systems. DualEntry unifies approvals, payment methods, and vendor records in a single platform, keeping your team audit-ready and always in sync.

For CFOs

DualEntry centralizes AP workflows and automates reconciliation across multiple entities so you can avoid late fees and make data-driven decisions.You’ll also have full visibility into cash flow across currencies and subsidiaries.

For controllers

Close the books faster and 100% accurately with automated invoice entry and approvals. Real-time data keeps you on top of spend and compliance as your business scales.

For AP managers

No more tracking down missing documents or sending reminders. With DualEntry’s AI-driven automation you can process invoices quickly, match payments, flag anomalies, and route approvals.

For procurement teams

Intelligent routing and instant status updates automate PO creation, approval, and tracking. With DualEntry, every purchase request is correctly logged and approved, preventing bottlenecks and giving you complete control.

Everything you need from

a treasury management

without the extra charges

| Feature |  |  |  |  |

|---|---|---|---|---|

| AI prioritization | Not available | Not available | Not available | |

| AI invoice monitoring | Basic alerts (add-on) | Not available | Not available | |

| AI reconciliation | Requires 3rd-party tool | Not available | Auto-match via bank rules | |

| AI duplicate detection | Requires 3rd-party tool | Not available | Ref # matching only | |

| AI journal-entry creation | Requires configuration | Manual entry | OCR populates bill | |

| Automated invoicing | Add on (Bill Capture) | Requires 3rd-party tool | ||

| AI OCR and document detection | Add on (Bill Capture) | Requires 3rd-party tool | ||

| Automated exceptions | Rule-based/manual | Workflow or rules | ||

| Streamlined communication | No vendor access | No vendor access | ||

| Automatic transaction matching | 2/3-way via add-on | Manual matching | PO link & bank rules | |

| Custom approval workflows | Basic rules only | |||

| Flexible workflows | Limited | |||

| Automated reminders | Not native | |||

| Live insights / dashboards | Basic BI | Manual dashboards | ||

| AI payment matching | Requires add-on | Not available | Limited | |

| 13,000+ bank connections | ~10K (Yodlee) | Limited/manual | ||

| Unified AP management | Needs extensions | Per company file | ||

| Custom reporting |